52 Solved Questions with Answers

-

2024

Examine the pattern and trend of public expenditure on social services in the post reforms period in India. To what extent this has been in consonance with achieving the objective of inclusive growth? (Answer in 150 words)

Approach:

- Give a brief introduction about Public Expenditure on social services

- Mention the pattern and trend of public expenditure

- State the extent public expenditure in achieving inclusive growth

- Conclude suitable

Introduction:

The government expenditure on social services grew at a 5.9% CAGR from FY12 to FY23, reflecting increased focus on education, healthcare, and rural development since the 1991 reforms for inclusive growth.

Body:

Pattern and Trend of Public Expenditure on Social Services (Post-Reform Period):

- Increase in Allocation: Social services spending grew from 5.3% of GDP in 2000-01 to 8.3% in 2022-23, with a focus on education, health, and welfare.

- Education Sector: Increased from 2.8% to 3.1% of GDP by 2022-23. The FY 2023-24 budget allocated Rs.1.12 lakh crore.

- Health Sector: Grew from 0.9% to 2.1% of GDP by 2022-23. FY 2023-24 allocation is Rs.89,155 crore.

- Social Welfare Programs: MGNREGA funding rose from Rs.60,000 crore in 2023-24 to Rs.86,000 crore in 2024-25 for poverty alleviation.

- Skilling and Digital Inclusion: Programs like Digital India and Skill India (20 lakh youth will be skilled over a 5-year period- Budget 2024-25) are receiving increased funding to boost digital literacy, bridge the digital divide, and provide employment through skill development initiatives.

Consonance with Achieving Inclusive Growth

Despite increased public expenditure on social services, allocations remain modest for the population's needs.

- Education: Access has expanded, but challenges in quality and equity persist (GER for the age group 18-23 years in India is 28.4%).

- Health: Spending has risen, yet India lags in rural healthcare and access for marginalised groups.

- Poverty and Inequality: Welfare programs help reduce poverty, but inclusive growth is hindered by fund underutilization and implementation issues.

Conclusion:

Public expenditure on social services in post-reform India has risen to support inclusive growth. Achieving true inclusive growth requires better resource efficiency and targeted beneficiary support. Efforts must continue to address these issues while maintaining investment in social sectors.

-

2024

What are the causes of persistent high food inflation in India? Comment on the effectiveness of the monetary policy of the RBI to control this type of inflation. (Answer in 150 words)

Approach:

- Introduce with brief comment on food inflation with relevant facts/data.

- Highlight factors like climate change, supply chain issues, and rising production costs.

- Briefly mention RBI’s Flexible Inflation Targeting (FIT) approach.

- Assess the RBI's success in managing overall versus food inflation.

- Note the limits of monetary policy on supply-side issues.

- Conclude suitably on a positive note.

Introduction

According to CPI, in August 2024, food inflation was 5.66%, with rural inflation at 6.02% and urban inflation at 4.99%. Persistent high food inflation in India poses economic challenges and understanding its causes is essential for assessing the effectiveness of the Reserve Bank of India's monetary policy.

Body:

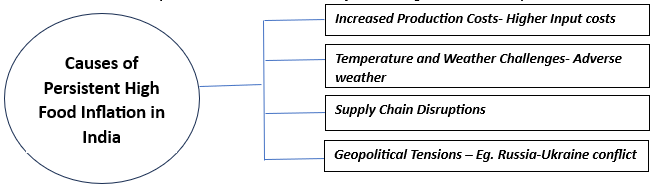

Causes of Persistent High Food Inflation In India

Effectiveness of RBI's Monetary Policy in Controlling Food Inflation

The RBI aims for 4% inflation via the Flexible Inflation Targeting (FIT) framework, but food inflation remains a significant challenge despite its measures.

- The FIT approach aims for price stability and growth, but persistent food inflation from supply-side shocks complicates this.

- The RBI adjusts rates to control inflation, but food prices resist due to factors like climate change and global prices.

- Monetary policy actions take 2-3 quarters to impact the economy, reducing their effectiveness for short-term food price shocks.

Conclusion

While the RBI's monetary policy is crucial for managing inflation, tackling persistent food inflation in India needs a holistic approach. In consonance with targeted fiscal policies, structural reforms, improved agricultural practices, and better supply chains will ensure long-term stability, benefiting consumers and the economy.

-

2024

What were the factors responsible for the successful implementation of land reforms in some parts of the country? Elaborate. (Answer in 150 words)

Approach:

- Write in brief about land reforms in India.

- Discuss the reasons for its successful implementation in some regions of the country.

- Conclude by summarising the the factors mentioned in the main body

Introduction

- Land reform is a type of agrarian reform where the ownership or management of land is changed, usually through government policies for the welfare of the poor landless peasants. The Land Reforms included abolition of the intermediaries, tenancy reforms, land ceiling and land consolidation.

Body

Factors responsible for the successful implementation of land reforms in some parts of the country like West Bengal and Kerala were:

- Strong Political Will and Legislations: Governments of the state effectively implemented land reforms. Laws like the Bihar Land Reforms Act (1950) and Bombay Tenancy Act (1948) facilitated reforms.

- Peasant Movements: Mobilisation under Operation Barga in West Bengal led to sharecropping reforms.

- Land Reforms from Below: The Bhoodan and Gramdan movements in Telangana encouraged voluntary land renunciation for redistribution.

- Efficient Land Records Management: Digitization in states like Karnataka reduced disputes and corruption.

- Political Awareness: Agrarian issues during the freedom struggle heightened acceptance of land reforms.

Factors responsible for the poor implementation of land reforms in other parts:

- Poor land records leading to discrepancies in property descriptions and boundaries.

- Political and bureaucratic apathy leading to delays.

- Not including plantations in land reforms led to unsuccessful outcomes.

- Land ceilings were set very high which helped people bypass ceiling laws.

Conclusion

Digital India Land Records Modernization Programme (DILRMP), Promoting cooperative and collective farming and leveraging Geographic Information Systems (Swamitva scheme) can make land reforms implementation successful.

-

2024

Discuss the merits and demerits of the four Labour Codes' in the context of labour market reforms in India. What has been the progress so far in this regard? (Answer in 250 words)

Approach:

- Give a brief introduction about the Labour Codes

- Outline the merits and demerits of the Labour Codes, and discuss the progress made so far

- Conclude suitably

Introduction:

The four Labour Codes in India—on Wages, Industrial Relations, Social Security, and Occupational Safety—represent a significant overhaul of the country’s labor laws.

Body:

Merits:

- Simplification of Laws: Consolidating over 40 labour laws into four codes simplifies compliance for businesses, reducing legal complexities.

- Improved Flexibility for Employers: The Industrial Relations Code has raised the retrenchment threshold for firms without government approval from 100 to 300 employees.

- Enhanced Worker Protections: The Social Security Code extends benefits to gig and platform workers.

- Occupational Safety and Health: The Occupational Safety Code mandates stricter workplace safety standards. This includes health checks, safety committees, and better facilities for workers.

Demerits:

- Ambiguity in Definitions: Unclear definitions of workers and gig workers may lead to exploitation and confusion.

- Exclusion of Vulnerable Workers: The Occupational Safety, Health and Working Conditions Code does not cover charitable organisations or NGOs, leaving a significant part of the social service sector unprotected.

- Resistance from States: Some states lag in implementation, risking inconsistencies in labour laws.

- Reduced Collective Bargaining: The 75% worker support requirement for union recognition may fragment representation and hinder collective bargaining.

- Potential for Exploitation: Fixed-term contracts may result in worker exploitation and diminished rights.

Progress so far:

- Legislative Approval: All four Labour Codes have been passed by Parliament and received presidential assent.

- Yet to be Implemented: Passed in 2019 & 2020, the codes are yet to be implemented.

- As of June 2024, 24 states and union territories (UTs) in India have formed rules under all four new labor codes

Conclusion:

The implementation of these codes is expected to bring significant changes to India’s labor market, aiming to simplify and modernize labor laws, but the final rollout is still awaited.

-

2024

What is the need for expanding the regional air connectivity in India? In this context, discuss the government's UDAN Scheme and its achievements. (Answer in 250 words)

Approach

- Start the answer with providing the significance of regional connectivity in a vast and rapidly developing country like India.

- Provide how India’s RCS-UDAN Scheme has been a step in the right direction in this context.

- Discuss the key versions of the scheme and its achievements.

- Provide a suitable conclusion.

Introduction

Expanding regional air connectivity is crucial for achieving comprehensive and inclusive development in India. To enhance regional air connectivity, the Government of India introduced the Regional Connectivity Scheme – Ude Desh Ka Aam Nagrik (RCS-UDAN) Scheme.

Body

Regional Air Connectivity – A Necessity:

- Enhanced connectivity stimulates local economies by facilitating trade, tourism, and investment in remote areas.

- Improved air links ensure better access to essential services for people in underserved regions.

- Increased air traffic can lead to job opportunities in aviation, hospitality, and related sectors, benefiting local communities.

- Better connectivity boosts tourism in remote and scenic areas, alongside reducing the urban-rural divide, promoting equitable growth.

- Better air connectivity facilitates quicker response times during natural disasters.

RCS-UDAN :

- UDAN Scheme is part of the National Civil Aviation Policy 2016, aims to improve infrastructure and connectivity in India, especially in remote and underserved regions and fulfil the aspirations of the common citizens.

Achievements:

- Since its inception, the UDAN scheme has witnessed the launch of various versions, with the most recent ones being UDAN 5.1, 5.2 and 5.3 focussing on last-mile connectivity and tourism through small aircraft.

- The scheme has benefited more than 1 crore passengers and operated more than 2.5 lakh flights, enhancing airport development and making air travel more accessible and affordable while also creating job opportunities.

- As of April 2024, 85 airports have beVYen operationalised under the scheme.

- RCS-UDAN is connecting 30 States/ UTs across the length and breadth of the country (e.g. From Mundra (Gujarat) to Tezu in Arunachal Pradesh to Hubli in Karnataka) operationalising underserved and unserved airports, heliports and water aerodromes.

Conclusion

Despite ongoing efforts, challenges remain due to incomplete functionality of operational routes, often stemming from low occupancy rates and insufficient infrastructure. However, RCS-UDAN has transformed the aviation landscape by connecting remote areas and making air travel more affordable for lower middle-class citizens.

-

2023

Faster economic growth requires increased share of the manufacturing sector in GDP, particularly of MSMEs. Comment on the present policies of the Government in this regard.

Most nations that fall in the category of developed states were centres of manufacturing at some point or other. Manufacturing creates the most value, at mass for nations. Small industries can contribute immensely to the GDP considering 50% of our imports and around 30% of GDP comes from Micro, Small and Medium Enterprises (MSME).

Government policies to boost manufacturing

- Make in India Initiative: The programme aims to facilitate investment, foster innovation, and build infrastructure for manufacturing. It aims to promote India as a global manufacturing hub.

- Industrial Corridor Development Programme: This is implemented in collaboration with state governments to develop greenfield industrial regions.

- Ease of Doing Business: The objective is simplification of procedures, rationalisation of legal provisions, digitisation of government processes, for an ease of doing business.

- National Single Window System: It provides a one-stop shop and support to investors, including pre-investment advisory, provide information related to land banks and facilitate clearances at Centre and State level.

- PM Gati Shakti National Master Plan (NMP): It seeks to facilitate data-based decisions related to integrated planning of multimodal infrastructure, thereby reducing logistics cost.

Policies particularly for MSMEs

- Udyami Mitra Portal: It improves accessibility of credit and handholding services.

- MSME Sambandh: To monitor the implementation of the public procurement from MSMEs by Central Public Sector Enterprises.

- MSME Samadhan: It provides resolution on cases related to delayed payment by Government organisations.

- Digital MSME Scheme: It provides cloud-based infrastructure for MSMEs.

MSMEs contribute around 8% to India's GDP, employ over 60 million people, and have a significant share in exports and manufacturing. Therefore, they are crucial for the overall economic development of India. In the last few years, MSMEs have grown considerably and will continue to do so considering the growing trends and conducive policies.

-

2023

What is the status of digitalization in the Indian economy? Examine the problems faced in this regard and suggest improvements.

Digitalization is the process of moving to an internet-based infrastructure of doing things which generally increases economic and managerial efficiency in a business.

Indian economy has ample scope and potential of digitalization as around 77% of the population has active cellular connection and 1/3 of the population uses social media. With penetration rate of 48.7% India has around 700 million internet users.

Problems in digitalization

- Cost: While digitalization reduces operational costs for the business, setting up infrastructure is a high-cost occurrence.

- Infrastructure: The unavailability of internet and its regular services in areas with less infrastructural development is a problem.

- Privacy: A grave concern with digitalization is the vulnerability to security breaches and subsequent compromising of data.

- Digital Literacy: Digital literacy in India is also low especially in rural areas. Women have even lower digital literacy.

Possible improvements

- Comprehensive Policy: Policies that address the current issues of privacy, security, digital literacy and work towards building infrastructure are needed.

- Investments: Digital infrastructure and digital literacy need to be worked on and thus significant investing needs to be done.

While the digitalization in India has grown sharply in the past few years, with digital economy’s contribution to Gross Value Added (GVA) increasing from 5.4% in 2014 to 8.5% in 2019 much work still needs to be done.

-

2023

State the objectives and measures of land reforms in India. Discuss how land ceiling policy on landholding can be considered as an effective reform under economic criteria.

Land holding, introduced on the recommendation of the Kumarappa committee, has transformed India immensely in various social, political and economic dimensions.

Objectives of land reform

- Restore Rights of Cultivators: Through introduction of these reforms, rights of the small farmers who were traditionally owners of their lands was restored.

- Records: Updation of records to reduce disputes among citizens has been achieved.

- Empowerment: It has led to empowerment of marginalised communities as they often have low land holding that contribute to reduced socioeconomic status.

- Social Equality: Equitable distribution of resources leads to reduced social marginalisation.

Measures taken

- Land Ceilings: Government put up a cap on the amount of land that could be kept by a person or family.

- Abolition of Zamindari: This was achieved through passing of various legislations by states, e.g., the Zamindari Abolition Act, 1950 (Uttar Pradesh).

- Cooperative Farming: Farmers were encouraged to pool resources and do farming as a community.

The land ceiling policy imposes limits on the maximum extent of land an individual or family can own. By limiting land ownership, land ceiling policies aim to reduce the concentration of land in the hands of a few wealthy landowners.

Land ceiling as an effective reform

- Increased equitable land distribution contributes to a wider base of population that can contribute immensely to economic growth of the country.

- With a wider population experiencing economic growth, people are bound to get better health, and prefer better education for their offspring. This elevates standard of living.

- Wider tax base is provided with increased number of farmers earning from their lands, which leads to better tax collection.

Land reforms in India have not just helped in providing resources to the landless, but also in addressing historical injustices and imagining a more inclusive future.

-

2023

Most of the unemployment in India is structural in nature. Examine the methodology adopted to compute unemployment in the country and suggest improvements.

Structural unemployment is basically an involuntary unemployment that occurs because of a structural change in the economy, such as the development of a new technology or industry or due to the mismatch in skills possessed by the populations and the job available in the market.

Major reasons for structural unemployment in India include labour market rigidities, geographic mismatch, agriculture dependency, infrastructure bottlenecks, and regulatory challenges.

Methodology adopted to compute unemployment in the country

- Computation by NSSO using:

- Current Weekly Status (CWS): Under this, a shorter reference period of a week is adopted. Individuals are counted as employed if they have worked for at least one hour on at least one day in the preceding seven days. For example, Labour Force Participation Rate in CWS in urban areas for persons aged 15 years and above increased to 48.2 per cent in the October-December quarter of 2022.

- Usual Principal and Subsidiary Status (UPSS): It is determined based on the activity one spent the most time in the previous year.

- Current Daily Status: It indicates the number of people who did not find work for one or more days in a week.

- Labor Bureau Surveys: Labor Bureau conducts survey to obtain data on unemployment and employment in India. For example, All-India Quarterly Establishment-based Employment Survey (AQEES).

Way forward

- Increase in Frequency of Surveys: It is important to ensure timeliness and updating of the surveys as increased frequency provides better understanding of changing employment trends.

- Modernizing Agriculture: Increase in investment in agriculture could have a multiplier effect through backward and forward linkages, e.g., promoting cold storages.

- Incorporation of Informal Sector: More than 80 percent of the labour force is employed in informal sector which needs to be incorporated in the formal sector.

- Seasonal Adjustments: Improve seasonal adjustment techniques to account for the impact of agriculture and other seasonal employment trends.

To conclude, it is high time that certain computational methodologies need to be enhanced to envisage making India as one of the largest economies and nurture the rich demographic dividends with few bottlenecks and unemployment hurdles.

- Computation by NSSO using:

-

2023

Distinguish between ‘care economy’ and ‘monetized economy’. How can care economy be brought into monetized economy through women empowerment?

The ‘care economy’ and ‘monetized economy’ deal with nature and value of the work and are two different aspects of economic activities.

Care economy refers to the unpaid or underpaid work related to caregiving and providing social support, often performed within households. For example, childcare, eldercare, domestic work etc. Inter alia, it also involves paid labour encompassing nurses, caregivers, etc. (often females). The compensation is generally absent or very meagre compensation is awarded for such activities. It is highly undervalued even though it supports human development and social cohesion.

Monetized economy includes all economic activities that are dealt with in terms of monetary value, which includes production of goods, e.g., finance, trade, etc. It is mainly aimed at profit generation. The compensation is received in terms of monetary value. Work done and goods produced in the economy are compensated in terms of wages, salaries, etc. It is assessed by its contribution to GDP and is often used as a measure of economic growth.

Ways to integrate care economy into monetized economy through women empowerment

- Social protection measures are required that provide income security for women in caregiving roles. For example, pension insurance for women engaged in such roles.

- Development of skills for better transformation and incorporation of women into formal sector should be emphasized.

- Supportive government policies should be there to promote gender-neutral reforms and collaboration between government and civil society organizations in care giving economy.

- For example, National Creche Scheme for the Children of Working Mothers, enhancing of maternity benefits, etc.

- Technological solutions for care sector that reduces time and frees up women for formal sector employment can be considered.

Integration of care economy into monetized economy will not only enhance economic opportunities for women but also contribute to a more inclusive and equitable society.

-

2022

Why is Public Private Partnership (PPP) required in infrastructural projects? Examine the role of PPP model in the redevelopment of Railway Stations in India.

- Public-Private Partnerships (PPPs) are a mechanism for government to procure and implement public infrastructure and services using the resources and expertise of the private sector.

PPP in Infrastructure Projects

- Governments in developing countries face the challenge to meet the growing demand for better infrastructure services. Introduction of PPP will help in providing better infrastructure services through improved operational efficiency.

- The funding available and capacity of public sector to implement project on time remains limited, partnership with the private sector is an attractive alternative to increase and improve the supply of infrastructure services.

- PPPs are beneficial in supplementing limited public sector capacities to meet the growing demand for infrastructure development.

- It will develop local private sector through joint ventures with large firms in areas such as: civil works, electrical works, facilities management, security services, cleaning services, maintenance services.

- The long-term value-for-money is extracted through appropriate risk transfer to the private sector over the life of the project – from construction to operations.

Role of PPP model in the redevelopment of Railway Stations in India

- The station redevelopment comprises two components:

- Mandatory station redevelopment: It will make smooth and hassle-free travel.

- Station Estate (Commercial) development: It will enable to tap several revenue streams to ensure the viability of entire project.

- The Government of India pushing for reforms in railway infrastructure with the help of PPP. The first station redeveloped through PPP process is Gandhinagar in Gujarat.

- Other stations will be redeveloped such as New Delhi, Chhatrapati Shivaji Maharaj Terminus and many more including in tier 2 and tier 3 cities.

- The responsibility of train operations and safety certification rests with Indian Railways.

PPPs offer the public sector potential cost, quality, and scale advantages in achieving infrastructure service targets. NITI Aayog strategy for new India @ 75 envisages many targets in railway infrastructure like increasing the speed of infrastructure from the present 7 km/day to 19 km/day, 100% electrification of broad-gauge track by 2022-23.

-

2022

Is inclusive growth possible under market economy? State the significance of financial inclusion in achieving economic growth in India.

In a market economy, the production of goods and services is directed by the laws of supply and demand and by profit with no government intervention.

The Organisation for Economic Co-operation and Development (OECD) defines inclusive growth as economic growth that is distributed fairly across society and creates opportunities for all.

Achieving inclusive growth in a market economy is a difficult prospect.

- The absence of government intervention does not leave any substantial scope for social welfare schemes.

- The profit-driven efficient utilisation does not take into consideration the deprivations faced by the marginalised sections of the population.

- This often results in the further socio-economic weakening of these sections such as job loss, etc.

- Market economy encourages privatisation, which in an unregulated manner, can prove to be detrimental to a large section of the population (high education fees and exorbitant prices of vaccines, essential medicines, etc.).

Financial Inclusion is the process of ensuring access to financial services for vulnerable groups at affordable costs.

- The government has initiated several schemes such as PM Jan Dhan Yojana (PMJDY) and PM Mudra Yojana (PMJY) aimed at effecting financial inclusion in the country.

- These schemes are primarily to increase the coverage of the formal financial services in the country and enable a larger number of people to join the economic mainstream.

- The integration of a greater number of people into the formal economic system of the country and the development of the habit of saving which further contributes to economic growth.

- Extension of loans (PM Mudra Yojana) is also a key part of financial inclusion. With the availability of capital, more MSMEs, start-ups, etc., can be established that can play a crucial role in economic growth.

- Pension-related schemes (Atal Pension Yojana, etc.) also constitute a key part of financial inclusion. This allows the elderly population of the country to remain economically productive and allow them to lead a dignified life.

- Technology-driven financial inclusion (UPI) can also lead to economic growth since it helps in plugging leakages and enable larger people to integrate themselves with the formal financial services in the country.

The market economy despite being economically efficient is not the ideal system for the implementation of inclusive growth which is based on equity and socio-economic welfare.

-

2022

What are the major challenges of Public Distribution System (PDS) in India? How can it be made effective and transparent?

The Public distribution system (PDS) is an Indian food security system established under the Ministry of Consumer Affairs, Food, and Public Distribution. PDS is operated under the joint responsibility of the central and the state governments.

There are many issues associated with PDS system in India:

- Studies show that entitled beneficiaries are not getting food grains while those that are ineligible are getting undue benefits.

- TPDS (Targeted PDS) suffers from large leakages of food grains during transportation.

- Open-ended Procurement i.e., all incoming grains accepted even if buffer stock is filled, creates a shortage in the open market.

- A performance audit by the CAG has revealed a serious shortfall in the government’s storage capacity.

However, various measures can be taken to make it effective and transparent:

- Its effectiveness can be enhanced with technology-based solutions. Shifting towards DBT is another idea, but with caution.

- Increased public participation through social audits and participation of SHGs, Cooperatives and NGOs will ensure the transparency of the PDS system at the ground level.

- Integrating Aadhar with TPDS will help in the better identification of beneficiaries and address the problem of inclusion and exclusion errors. This will make PDS more effective.

PDS is one of the biggest welfare programmes of the government. Strengthening of the existing TPDS system by capacity building and training of the implementing authorities along with efforts to plug leakages is the best way forward.

-

2022

Elaborate the scope and significance of the food processing industry in India.

Industry, using processing methods, transforms agriculture product into food or consumable form is called as food processing industry.

Scope

- Indias has approximate 60.4 percent land as agriculture land.

- India is leading producer of fruits, vegetables, milk, meats and cereals.

- India is one of the largest consumer markets in the world.

Significance

- It can provide a profitable market to farmers. Profitable market can contribute to double the farmers income.

- It is a link between agriculture and manufacturing sector. It can contribute in employment generation.

- Organised supply of easily available processed food can help to reduce nutritional poverty in India.

- Smooth functioning of forward and backward linkages can curb the food inflation and can reduce the delay market ready products.

- Industry level processed food production can enhance the export capacity of Indian trade in international market.

Limitations

- Unorganised nature of this industry creates chaos to formulate comprehensive focused policy.

- Lack of robust Logistic infrastructure leads to wastage of food resources.

- Lack of proper functioning of backward and forward linkages led to Supply and demand side bottlenecks in economy.

- Lack of investment and technological upgradation hinders this industry to realize its true potential.

Way forward

- To harness the true potential of this industry, formalization of this sector is key.

- Greater investment and logistical infrastructure support can create new endeavours and job opportunities in this industry.

- Coordination of various government ministries and departments are needed to Greenfields projects and running projects.

- Need for integrated system to reduce post-harvest losses.it will further enhance agricultural products supply.

-

2022

The increase in life expectancy in the country has led to newer health challenges in the community. What are those challenges and what steps need to be taken to meet them?

Life expectancy is the estimate of the number of years an individual is expected to live. Life expectancy at birth is the most common measure of life expectancy.

India has witnessed a steady increase in life expectancy due to factors such as enhancement of public health coverage, improvement in sanitation and hygiene, etc. It currently stands at around 70 years in India.

The increase in life expectancy has led to newer challenges in the community.

- Extra burden on the already stressed public healthcare system.

- Vulnerability to diseases and other health-related issues due to several factors such as exposure to air pollution, recurring viruses and pandemics, etc.

- India has not witnessed an increase in “healthy life expectancy” with people now living longer with illness and disability due to the rising instances of non-communicable diseases.

- Increased financial burden on the families and the state due to the increased healthcare requirements of an ageing population (health insurance coverage, medical treatments, etc.).

- Accelerated utilisation of resources leading to issues in their distribution and management.

Nevertheless, steps can be taken to address these challenges.

- Increased awareness vis-à-vis diseases and health can improve the quality of health of the population.

- It can also lead to people living healthier lives and requiring lesser resources for their medical needs later in life.

- This can lead to a lesser economic burden on both the families and the state for looking after their medical requirements.

- Improvements in the public health system with respect to its quality and access are also required for meeting the challenges due to the increase in life expectancy

Thus, increased life expectancy has both positive and negative effects. With proper management, it can be utilised for effecting a positive outcome in the larger community and country.

-

2022

''Economic growth in the recent past has been led by increase in labour productivity.'' Explain this statement. Suggest the growth pattern that will lead to creation of more jobs without compromising labour productivity.

According to the International Labour Organisation (ILO), labour productivity represents the total volume of output (measured in terms of Gross Domestic Product, GDP) produced per unit of labour (measured in terms of the number of employed persons or hours worked) during a given time reference period.

In the recent past, India has witnessed economic growth driven by an increase in labour activity. Several key factors have contributed to this development.

One of the most important factors has been the prevalence of work-from-home since the onset of the Covid-19 pandemic. Working from home has allowed people to dedicate more time to their respective economic engagements and vocations resulting in higher labour activity and resultantly productivity.

Further, sectors such as ed-tech and other digitally driven fields have flourished during the same period and have contributed to higher labour activity and subsequently productivity and eventually to higher economic growth.

Also, the initiative taken by the government in launching several important schemes (Skill India) aimed at the upskilling of the workforce and encouragement to the start-up ecosystem (Startup India) has resulted in the creation of a skilled and well-equipped workforce.

Also, the reinstatement of economic activities after nearly two years of Covid-induced lockdowns has led to increased labour activity and productivity.

Several initiatives can be taken to create a growth pattern that ensures the creation of jobs without compromising labour productivity.

- Manufacturing-intensive industries, the MSME sector and start-ups should be promoted to ensure the creation of an adequate number of jobs to ensure without compromising labour productivity.

- Government, through capital expenditure can create jobs and ensure that labour productivity is not compromised.

- Further, it can also initiate programmes aimed at upskilling the workforce as well as increasing government recruitments in a financially prudent manner.

- A focus on automation and the introduction of new and efficient technologies is another method of maintaining labour productivity and ensuring economic growth.

- Efforts should be made to bring those sections of the population into the mainstream workforce that have hitherto not been able to make an active contribution to labour activity.

Thus, increased labour activity and the resultant increase in productivity and economic growth have been important features of the post-pandemic economy. An economic growth pattern that ensures its continuation is thus very important.

-

2022

Do you think India will meet 50 percent of its energy needs from renewable energy by 2030? Justify your answer. How will the shift of subsidies from fossil fuels to renewables help achieve the above bjective? Explain.

India at the COP 26th meeting of the United Nations Convention on Climate Change (UNFCCC) committed to the 5-point agenda programme. One of them is to meet 50% of its energy requirements from renewable energy by 2030.

To reach the above commitments India has already achieved few targets:

- India has overachieved its commitment made at COP 21- Paris Summit by already meeting 40% of its power capacity from non-fossil fuels.

- India is also one of the world’s largest producers of modern bioenergy.

- Today, India is the world's third largest producer of renewable energy, with 40% of its installed electricity capacity coming from non-fossil fuel sources.

- India's massive UJALA LED bulb campaign is reducing emissions by 40 million tonnes annually.

However, there are a few challenges in achieving the target:

- To meet the above target India will need massive funding. BlombergNEF (BNEF) report says that only to meet wind and solar energy targets India will need $223 Billion.

- In the short-term rising interest rates, a depreciating rupee and high-inflation create challenges for the financing of renewables.

- Even, to complete the targets Indian government needs to cut down its taxes for almost 2 lakh crores by 2030 which will effect the other sectors like education, health and infrastructure.

Fossil fuel subsidies by the Union government have fallen 742% since 2014 but the subsidies on coal, oil and gas increased by nine times in 2021-22. Still, the Fossil fuel subsidies in India nine times higher than renewable energy. So, there is no complete shift to subsidies on renewable energy sources.

Although, the shift of subsidies from fossil fuels to renewables will help in subsidies for E- vehicles and raising taxes on fossil fuels will help in achieving the above objective because giving subsidies to renewable sources will make it look cheaper and this will also work against the fossil-fueled incumbents that are preventing new renewable energy entrants access to the market. For example, giving subsidies for E- vehicles and raising taxes on fossil fuels will help in achieving levels needed by 2030 as it will contain global warming to the Paris goal of 1.5-2C.

-

2021

Explain the difference between computing methodology of India’s Gross Domestic Product (GDP) before the year 2015 and after the year 2015.

GDP is a measure primarily used as a yardstick to gauge the growth of an economy. In 2015, a new series was announced to calculate India’s GDP by upgrading the methodology with new data sources to meet UN standards.

Difference between old and new methodology:

- Change in Base Year

- Pre-2015: 2004-05

- Post 2015: 2011-12

- Change of base year to calculate GDP is done in line with the global exercise to capture economic information accurately.

- Change in data used to measure manufacturing sector growth

- Pre-2015: The performance of the manufacturing sector was previously evaluated using data from the IIP and the Annual Survey of Industries (ASI), which comprises over two lakh factories.

- Post-2015: Now, firms’ annual accounts filed with the Ministry of Corporate Affairs (MCA 21) are used, which includes around five lakh companies.

- GDP at factor cost replaced by GDP at market price

- Pre-2015: GDP at factor cost was calculated.

- Post-2015: Adopted the international practice of GDP at market price and for sector-wise estimate, Gross Value added (GVA) at basic price.

- The new measures include not only the cost of production but also product subsidies and taxes.

- Calculation of labour income

- Pre-2015: All labour used to be equal.

- Post-2015: The new series has used a concept called “effective labor input”. Different weights are assigned on whether one was an owner, a hired professional or a helper.

- Change in the way value addition in agriculture was captured

- Pre-2015: It was confined to value addition in farm produce.

- Post-2015: Value addition in agriculture is now taken beyond farm produce.

- Livestock data is now critical to the new method.

- Capturing income generated by Financial Sector

- Pre-2015: Financial corporations in the private sector, other than banking and insurance, was limited to a few mutual funds (primarily UTI) and estimates for the Non-Government Non-Banking Finance Companies as compiled by RBI.

- Post-2015: The coverage of financial sector has been expanded by including stock brokers, stock exchanges, asset management companies, mutual funds and pension funds, as well as the regulatory bodies, SEBI, PFRDA and IRDA.

The new method is statistically more robust since it estimates more indicators such as consumption, employment, and the performance of enterprises, and incorporates factors that are more responsive to current changes.

- Change in Base Year

-

2021

Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets.

According to Article 112 of the Indian Constitution, the Union Budget of a year is referred to as the Annual Financial Statement (AFS). It is a statement of the estimated receipts and expenditure of the Government in a financial year (which begins on 01 April of the current year and ends on 31 March of the following year).

Objectives of Budget:

- Reallocation of resources

- Reducing inequalities in income and wealth

- Contributing to economic growth

- Bringing economic stability

- Managing public enterprises

Components of government budgets:

Capital Budget

Revenue Budget

- It includes the Capital Receipts and Capital Expenditure.

- It consists of the Revenue Expenditure and Revenue Receipts.

- Capital Receipts indicate the receipts which lead to a decrease in assets or an increase in liabilities of the government.

- It consists of:

- the money earned by selling assets (or disinvestment) such as shares of public enterprises, and

- the money received in the form of borrowings or repayment of loans by states.

- Revenue Receipts are receipts which do not have a direct impact on the assets and liabilities of the government.

- It consists of the money earned by the government through tax (such as excise duty, income tax) and non-tax sources (such as dividend income, profits, interest receipts).

- Capital Expenditure is used to create assets or to reduce liabilities.

- It consists of:

- the long-term investments by the government on creating assets such as roads and hospitals, and

- the money given by the government in the form of loans to states or repayment of its borrowings.

- Revenue Expenditure is the expenditure by the government which does not impact its assets or liabilities.

- For example, this includes salaries, interest payments, pension, and administrative expenses.

- It is non-recurring in nature. It is usually a one-time expenditure for a long period of time.

- It is recurring in nature (on a yearly basis).

-

2021

How did land reforms in some parts of the country help to improve the socio-economic conditions of marginal and small farmers?

Land reform is a form of agrarian reform involving the changing of laws, regulations, or customs regarding land ownership. Under the British Raj, the farmers did not have the ownership of the lands they cultivated. In post-independent India, many initiatives were taken for bringing land reforms and improving the deplorable conditions of farmers.

Land reforms helped to improve the socio-economic conditions of marginal and small farmers in the following ways:

- Abolition of the zamindari system: This removed the layer of intermediaries who stood between the cultivators and the state. It kept in check the debt trap and increased the share of marginal and small farmers in the production cost.

- Tenancy reforms: The rent paid by the tenants during the pre-independence period was exorbitant. Tenancy reforms introduced to regulate rent, provide security of tenure and confer ownership to tenants.

- Ceilings on landholdings: It was to deter the concentration of land in the hands of a few. It ensured redistribution of land from big landlords to landless labourers ensuring land ownership, access to credit, and food security.

- Consolidation of landholdings: It prevented the subdivision and fragmentation of land holdings. It brought down the cost of cultivation and reduced litigation among farmers and generated higher incomes.

- Cooperative farming: Under the mechanism, each member farmer remains the owner of his land but farming is done jointly. Profit is distributed among the member farmers in the ratio of land owned.

Challenges with the land reforms:

- Land reforms were lengthy and cumbersome process.

- Benami transactions became a point of concern under land ceiling act.

- Digitisation of land records with efficiency and correct information will take time.

The pace of implementation of land reform measures has been slow but the objective of social justice has been achieved to a considerable degree. New and innovative land reform measures should be adopted with new vigour to eradicate rural poverty and improve the socio-economic conditions of marginal and small farmers.

-

2021

Do you agree that the Indian economy has recently experienced V-shaped recovery? Give reasons in support of your answer.

V-shaped recovery is characterised by a quick and sustained recovery in measures of economic performance after a sharp economic decline. It is very apt to state that the Indian economy has recently experienced V-shaped recovery.

Supportive arguments:

- Quarterly GDP Growth: The COVID-19 pandemic has been a human and economic catastrophe for India. Almost one-fourth of the country’s economic activity was wiped out due to fall in domestic demand in wake of the strict nationwide lockdowns. India’s GDP dipped a historic 23.9% in the first quarter (Q1) of 2020. The contraction narrowed down to 7.5% in the second quarter (Q2).

- Rise in Government Expenditure: Total expenditure of the government rose 48.3% on year-on-year basis in the month of November. On the other hand, capital expenditure shrugged off a three-month contraction and expanded 248.5%. This was mainly due to the introduction of the Atmanirbhar Bharat package.

- Revival of Imports/Exports: After dipping for 9 consecutive months, merchandise imports finally experienced a growth of 7.6% (y-o-y) in December 2020. The revival was led by gold, electronic goods and vegetable oils. India’s merchandise exports have reached pre-COVID-19 levels and exhibited a growth of 0.1% in December 2020.

- Financial Markets Surge: The COVID-19 pandemic kept the Sensex to a record low in late March 2020. However, it staged a strong recovery from the lows. Both the BSE and NSE indices finally wrapped up 2020 on a bullish note.

- IPO Market: During December 2020, the listings of two Initial Public Offerings (IPOs), aggregating Rs. 1,351 crore, took the total resource mobilisation through main board IPOs to Rs. 15,971 crore during 2020-21 (up to December 2020), marking a sharp rebound from Rs. 10,487 crore in the corresponding period of the previous year.

- Industrial Activity: Although industrial output remains volatile, contracting by 1.9% in November 2020 after a record expansion in October by 4.2%, industrial activity is finally turning around. The headline Purchasing Managers’ Index (PMI) manufacturing expanded in December 2020 to 56.4, a tick higher than November’s reading of 56.3.

- Record GST Collections: The gross Goods and Services Tax collections touched a record high of over Rs. 1.15 lakh crore in December - the highest since the implementation of the regime. The collection indicates that the economy continues to show signs of recovery after a stringent lockdown.

-

2021

“Investment in infrastructure is essential for more rapid and inclusive economic growth.” Discuss in the light of India’s experience.

Infrastructure investments are a form of “real assets” which contain physical assets one sees in everyday life like bridges, roads, highways, sewage systems or energy. Such a type of asset is quite vital in a country’s development. Often, investors invest in infrastructure as it is non-cyclical and it offers stable and predictable free cash flows.

Benefits of investment in infrastructure:

- Stable and Steady Cash Flows: The potential for steady cash flows is one of the main attractive features of investment in infrastructure. It creates steady and predictable cash flows, given that the asset often comes with a regulated and contracted revenue model.

- Non-Cyclical: While the small Italian restaurant at the corner of the street may go bankrupt during a long economic recession, that same risk does not apply to infrastructure assets. Infrastructure assets are crucial to a country’s development which also means that they will still be used regardless of what stage the economy is in.

- Low Variable Costs: Infrastructure comes with extremely small marginal costs per use which are completely negligible.

- High Leverage: Leverage is the amount that is taken on. Given that infrastructure provides stable and predictable cash flows, it can take on high levels of leverage which leads to high-interest costs.

Role of infrastructure in rapid and inclusive economic growth:

- Creation of Jobs: Infrastructure development such as road construction, real estate, railway construction, etc. is labour-intensive resulting in increase in employment opportunities in formal and informal sectors and, thus, propelling domestic demand.

- Farmer Income: Investment in infrastructure would play a crucial role in ensuring doubling of farmers’ income through emphasis on increased irrigation infrastructure and storage, processing and marketing infrastructure.

- Health and Well-Being: Infrastructure enhancement of superior healthcare facilities, electronic health records and better equipped health infrastructure at primary levels (Telemedicine).

- Logistic Cost: Establishing world class roads, railways, ports and inland waterways will cut down logistic costs and improve competitiveness and promote exports. This would bring more revenues to the government and may promote socio-economic development.

India has been quite attentive with respect to infrastructure programmes. Setting up of a Development Finance Institution (DFI) with an initial capital of Rs. 20,000 crores, is expected to serve as a catalyst for facilitating infrastructure investment. Likewise, the National Infrastructure Pipeline seeks to boost the country’s spending on infrastructure.

However, the success of the infrastructure expansion plan would depend on other stakeholders of the pipeline playing their due role. These include State governments and their public sector enterprises and the private sector. Besides, there shall be proper implementation of holistic reforms in the banking sector.

-

2020

Explain intra-generational and inter-generational issues of equity from the perspective of inclusive growth and sustainable development.

Inter-generational (between the present and future people) and intra-generational (between the rich and the poor of the present generation) equity are two hands of the doctrine of sustainable equity.

Inter-generational equity and issues

- Mahatma Gandhi once said, “Earth provides enough to satisfy every man’s needs, but not every man’s greed”. One ofthe primary objectives of inter-generational equity isthe sustainable use ofresources by one generation to enhance economic sustainability for the future generation.

- Inter-generational equity has become crucial in the present times, due to the growing imbalance in the distribution of resources, ongoing degradation of environment and overexploitation of resources.

- This imbalance is more profound between the developed and developing nations or between the Global North and the Global South. Moreover, the developed countries are today unwilling to help developing countries adapt and mitigate climate change impacts.

Intra-generational equity and issues

- Progress of a society should be determined by the state ofthemost vulnerable and the weakest ones: Mahatma Gandhi

- The concept of intra-generational equity provides rights and duties to every person of a single generation to use and take care of the resources justifiably so that benefits are reaped by every section of society.

- In order to promote intra-generational equity, the concept of social justice is propagated. Welfare schemes like subsidies, reservations, etc. are provided by the governments to help the vulnerable section of society but these are often marred in corruption and inefficient implementation.

- The doctrine offreemarket demandsrollback ofstate and projectsthemarket asthe solution of every problem. However, the pro-market reforms of 1991 have failed to have the trickle-down effect.

The concept of inclusive growth and sustainable development are the key pillars ofthe global welfare narrative, which can be prompted by ensuring intra-generational and inter-generational equity.

-

2020

Define potential GDP and explain its determinants. What are the factorsthat have been inhibiting India from realizing its potential GDP?

Potential GDP is one of the theoretical aspects of national income accounting which assumes that an economy has achieved full employment and that aggregate demand does not exceed aggregate supply. Like other national income accounting methods, potential GDP also represents the market value of all goods and services but rather than capturing the current objective state of a nation’s economic activity, it attempts to estimate the highest level of output an economy can sustain over a period.

Determinants of Potential GDP

- Capital Stock: In an economy, capitalstock isthe plant, equipment, and other assetsthat help with production. The availability of capital stock determines the extent of economic output and potential GDP.

- Labor Force: At any given moment in time, the quantities of capital, land, etc., are typically fixed, but the quantity of labor employed varies. Therefore, in the short-run, Potential GDP depends on the quantity of labor employed, which depends on demographic factors and on participation rates.

- Non-accelerating Inflation Rate of Unemployment: It is the specific unemployment rate at which the rate of inflation stabilizes – inflation will neither increase nor decrease.

- Other determinants of Potential GDP are the level of labor efficiency, labor market efficiency, production capacity, sufficient liquidity, government fiscal support, etc.

Factors Inhibiting India from Realizing its Potential GDP

- Negative Output Gap: A negative output gap occurs when actual output is less than what an economy could produce at full capacity. A negative gap means that there is spare capacity, or slack, in the economy due to weak demand.

- Fall in Private Consumption: Private consumption is the prime component of India’s GDP as it contributes a significantshare to GDP (More than 55%). Indian economy experienced a sharp decline in private consumption expenditure in the past few quarters. Such decline in private consumption de-incentivizes firms in producing more goods, thereby the economy is left with unutilized resources and labor force.

- Mounting NPAs of Banks: The Indian banking system is under the huge burden of NPAs (Non-Performing Assets), which has tremendously reduced banks’ lending capacity. This has severely affected businesses, production houses and particularly the real estate segment. Such liquidity shortages reduce the productive capacity of the economy.

- Unemployment: Huge unemployment in India is also one of the major factorsthat inhibitsIndia from realizing its Potential GDP.

- Informal Economic Activities: Most of the economic activities in India are informal or unorganized and the size of such unorganized sectors is considerably huge but not accounted for in GDP. Therefore, the value of such an economy is not recorded in the national account book and remained unreleased.

- Other Factors: Weak intellectual property rights, low expenditure on R&D, contract enforcement issues, etc.

Way Forward

- Need to work more on the policy levels to generate employment, efficient and cost-effective resource mobilization, to promote export and innovation and to enhance the scope of Make in India Programme.

- Better wages must be ensured so as to increase private consumption expenditure.

- The negative output gap in GDP needs to be managed and compensated through various fiscal and monetary policy measures keeping inflation in check.

- The government needs to bring policies that catalyse rural economic growth.

-

2020

Explain the meaning of investment in an economy in terms of capital formation. Discuss the factors to be considered while designing a concession agreement between a public entity and private entity.

In the context of economy, investment refers to the expenditure made for the creation of capital assets or capital goods that are used to generate future income and wealth. Investment is elucidated and defined as an addition to the stockpile of physical capital such as machinery, buildings, equipment, roads etc. Investment is crucial for capital formation as it leads to more capital accumulation thereby increases national economic output.

Economic Impact of Investment

- Investment leads to the addition of capital stock in the economy.

- It enhances the production capacity of the economy.

- More the production, more will be the gross domestic product (GDP).

- In the later stage, it may also encourage domestic savings.

A concession agreement is a negotiated contract that grants rights to a company by a government, local authority, or other legal entity. It basically means a Public-Private Partnership (PPP) which allows joint development and maintenance of government projects.

Factors that need to be considered while designing a concession agreement

- The time of concession agreement should be very well defined.

- It should be clear about the fees, time period and authority.

- It should be clear about the authority, who will manage, maintain and repair the project in a timely manner.

- It should be clear about timely financing including viability gap funding.

- It should be clear about requirements of environmental impact assessment and requirement of land clearance.

Concession agreements are of fundamental importance for the development of infrastructure in the country. It has reduced the time lags and costs involved in undertaking such agreements. Therefore, a well-designed concession agreement will not only help in performance improvement but also help in reducing contract disputes.

-

2020

Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions?

The Goods and Services Tax is a comprehensive, multi-stage, destination-based tax. It is a single domestic indirect tax law which has subsumed many indirect taxes in India such as services tax, VAT, etc. The Goods and Service Tax (Compensation to States) Act, 2017 provides for a mechanism to compensate the States on account of loss of revenue which may arise due to implementation of the Goods and Services Tax.

Rationale behind this Act

- Raising new revenue sources: After the introduction of GST, States have very limited taxation rights as most of the taxes, barring those on petroleum, alcohol, and stamp duty, were subsumed under GST. This deficiency is fulfilled by the Union by compensating them.

- Fixed revenue growth: The compensation is calculated based on the difference between the states’ current GST revenue and the protected revenue after estimating an annualized 14% growth rate from the base year of 2015-16. If such a fixed amount is not assured, the Central Government will compensate States for such deficiency.

- Guaranteed compensation: Under the GST (Compensation to States) Act, 2017, states are guaranteed compensation for loss of revenue on account of implementation of GST for a transition period of five years between 2017 and 2022.

Impact of COVID-19 on GST compensation fund and creation of new federal tensions

- The gains of GST have started to quickly erode as the slowdown in the economy, exacerbated by the COVID-19 lockdowns, has thrown all revenue calculations to the wind.

- Due to huge shortfalls in the tax collection under GST the Central government and State Government has come at loggerheads as Centre has shown its incapability to compensate the States as promised under the GST Act 2017.

- The inability of the Government and binding clause in the Act, caused a conflict between federal ideas under the Constitution.

- Many states have concern over the compensation in this hour of need and questioned the Centre to break its federal agreement.

It is time for states to accept the realities and agree to a lower level of compensation, ideally linked to the growth rate of the Indian economy in nominal terms and the Centre must understand that it is their statutory obligation, and they can’t abrogate it. GST reforms must not fall victim to the trust deficit engendered by this standoff between the Centre and the States. Both must cooperate and coordinate in this hour of need.

-

2020

Describe the benefits of deriving electric energy from sunlight in contrast to the conventional energy generation. What are the initiatives offered by our government for this purpose?

India lying in the tropical belt has an advantage of receiving peak solar radiation for 300 days, amounting 2300-3,000 hours of sunshine equivalent to above 5,000 trillion kWh. India’s current installed solar power capacity, according to Central Electricity Authority, is 26025.97 MW which is 34% of total renewable energy sources i.e., 75055.92 MW till February 2019.

Benefits of deriving electrical energy from sunlight in contrast to the conventional energy generation

- Energy Security: India is dependent on imports to fulfill its energy demands, thereby incurring huge expenditure and uncertainty with regards to energy security. Thus, solar energy being cheap and easily available can fulfill the energy demands.

- Social Development: The problem of power cuts and unavailability of electricity, especially in rural areas, leads to improper human development. Mostly energy demands are fulfilled by subsidized kerosene, leading to loss for exchequer.

- Environment Concern: India’s large part of energy demand is fulfilled by thermal energy largely dependent on fossil fuels which causes environmental pollution. Solar energy is a clean form of energy resource, which can be a substitute.

- In solar power energy overhead wires are not required, so no transmission loss. Solar energy conversion equipment has a longer life and needs lesser maintenance and hence provides higher energy infrastructure security.

Initiatives offered by the government

- National Solar Mission initiative of the Government of India and State Governments promotes ecologically sustainable growth while addressing India’s energy security challenge.

- The Indian Renewable Energy Development Agency (IREDA) which provides term loans for renewable energy and energy efficiency projects.

- National Institute of Solar Energy is created as an autonomous institution under MoNRE, which is an apex body for R&D in solar energy.

- Establishment of solar parks and ultra-major solar power projects and enhancing grid connectivity infrastructure.

- Promotion of canal bank and canal tank solar infrastructure.

- Sustainable rooftop implementation of Solar transfiguration of India (SRISTI) scheme to promote rooftop solar power projects in India.

- Suryamitra programme to prepare qualified workforce.

- India also proposed the setting up of International Solar Alliance (ISA), a platform for the collaboration of sunshine countries in the domain of energy security.

With its pollution free nature, virtually inexhaustible supply and global distribution, solar energy is an extremely attractive energy resource. India, with its Intended Nationally Determined Contributions (INDCs) commitment of 100 GW of solar power out of 175 GW renewable energy by 2022, can surely benefit from this energy resource.

-

2019

Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017.

Goods and Services Tax (GST) is an indirect, comprehensive, multi-stage, destination-based tax that is levied on every value addition.

The Goods and Service Tax Act was passed in the Parliament in March 2017. The Act came into effect on 1st July 2017.

At the Central level, the following taxes have been subsumed in the GST:

- Central Excise Duty

- Additional Excise Duty

- Service Tax

- Countervailing Duty

- Special Additional Duty of Customs

At the State level, the following taxes have been subsumed in the GST:

- State Value Added Tax/Sales Tax,

- Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States)

- Octroi and Entry tax

- Purchase Tax

- Luxury tax

- Taxes on lottery, betting and gambling

Revenue implications of GST since July 2017:

- GST was introduced in July 2017. After the initial transitional issues following the roll-out of GST, revenue collection picked up from an annual average of 89.8 thousand crores in 2017-18 to 98.1 thousand crores in 2018-19.

- However in 2018-19, indirect taxes have fallen short of budget estimates by about 16 per cent, following a shortfall in GST revenues (including CGST, IGST and compensation cess) as compared to the budget estimates. Indirect taxes have fallen by 0.4 percentage points of GDP primarily due to shortfall in GST collections.

- According to the Economic Survey, though there has been an improvement in tax to GDP ratio over the last six years, gross tax revenues as a proportion of GDP has declined by 0.3 percentage points in 2018-19 over 2017-18.

-

2019

Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments.

The Economic Survey 2018-19 states that the economy witnessed a gradual transition from a period of high and variable inflation to a more stable and low level of inflation in period 2014-18. However, in the current fiscal quarter, the headline inflation has fallen to the lowest value and also there is a reduction in Gross Value Added (GVA). This has raised various debates around the use of inflation targeted monetary policy and its impact on the overall economy.

Points to agree

- Provided policy stability: Steady growth rate and low inflation has provided better market conditions for investment and production planning.

- More equitable: Inflation impacts the poor more as it decreases their purchasing power. Low inflation increases disposable income and therefore increases investment in the economy.

- Maintaining the fiscal deficit to the appropriate level: Controlled price level has helped in reducing subsidies and unnecessary tax cuts.

- Helping urban economy: Low inflation rate has kept the living cost in urban areas to a manageable level. This has provided relief to the middle class.

Points to disagree

- Fall in consumption demand: Decreasing Consumer Price Index (CPI) clearly shows the receding disposable income in rural areas which can be clearly seen in the Q2 GDP growth rate falling to 5%.

- Reduction in investment: The contraction of the economy due to falling consumption has reduced the scope of further investment.

- Double Balance Sheet Problem: Due to the slowdown, various corporates are facing the revenue shortage to pay back the interest, leading to NPA problem faced by the banks.

- Revenue Shortfall of the Government: Due to less income generation in the economy, direct tax revenue has receded. This reduces government legroom for more public expenditure.

Way forward

- Increasing liquidity: The recent step to slash the corporate tax and providing loans to MSMEs is the desired initiative to infuse more liquidity in the economy and increase investment.

- Increasing public expenditure: Schemes like MGNREGS, rural housing etc. should be implemented more effectively so as to give a boost to rural income generation and thus demand creation.

- Promoting labour-intensive industries such as Food Processing Industries, Leather Industries, etc. in order to create demand in the economy and provide employment to youths.

Current monetary policy easing should be continued to give a renewed push to the investment cycle of Indian economy. Inflation is a double edged sword therefore a sustainable range of the inflation rate of 4-6% should be maintained so that maximum income generation could happen in the economy.

-

2019

It is argued that the strategy of inclusive growth is intended to meet the objective of inclusiveness and sustainability together. Comment on this statement.

According to the World Bank, Inclusive Growth (IG) refers to 'broad-based', 'shared', and 'pro-poor growth'. It encompasses both the pace and pattern of growth, which is considered interlinked and therefore needs to be addressed together. Inclusiveness, on the other hand, is a concept that encompasses equity, equality of opportunity, and protection in market and employment transitions and is therefore an essential ingredient of any successful growth strategy.

- Rapid pace of growth is unquestionably necessary for substantial poverty reduction, but for this growth to be sustainable in the long run, it should be broad-based across sectors, and inclusive of the large part of the country’s labour force.

- Thus, IG focuses on productive employment rather than income redistribution as a means of increasing incomes for excluded groups. Also, the focus is not only on incremental productive employment growth but also on productivity growth.

- Growth can be ‘inclusive’ and “pro-poor”, if and only if the incomes of poor people grow faster than those of the population as a whole, i.e., inequality declines. By focusing on inequality, the inclusive growth could lead to optimal outcomes for both poor and non-poor households.

- Sustained, high growth rates and poverty reduction, however, can be realized only when the sources of growth are expanding, and an increasing share of the labour force is included in the growth process in an efficient way i.e. growth associated with progressive distributional changes will have a greater impact in reducing poverty than growth which leaves distribution unchanged.

- The inclusive growth approach takes a longer-term perspective, where it is important to recognize the time lag between reforms and outcomes. Inclusive growth analytics is about policies that should be implemented in the short run, but for sustainable, inclusive growth in the future.

- For Example: The lag between the time when investments in education are made and the time when returns from improved labour skills are realised- this implies that the growth analysis must identify future constraints to growth that may not be binding today, but that may need to be addressed today in order to ensure sustainable and inclusive growth.

- Sustainable development should be followed wherein we should not only be inclusive with respect to people but also bring the environment in its inclusion thus causing minimum depletion of resources and going for a circular economy.

- In the past few years, the government is aggressively focusing on the strategy of inclusive growth in its various programs and policies.

- For Example, Jan Dhan Yojana has focused on incorporating the unbanked masses into the financial sector and has increased financial inclusion statistics to more than 80%.

In the last few decades, India’s growth story has been phenomenal but the outcomes of this growth were not visible on the ground as India has performed badly in several social indicators as well as Human Development Index. Therefore inclusive growth is the idea to realize the dream of sustainable and qualitative development for present and future generations.

- Rapid pace of growth is unquestionably necessary for substantial poverty reduction, but for this growth to be sustainable in the long run, it should be broad-based across sectors, and inclusive of the large part of the country’s labour force.

-

2019

The public expenditure management is a challenge to the Government of India in the context of budgetmaking during the post-liberalization period. Clarify it.

The public expenditure management (PEM)is an instrument of state policy and mechanism for good governance. The broad objective of PEM is the achievement of overall fiscal discipline, strategic allocation of resources, operational efficiency and macro-economic stability.

Various challenges faced by the government with regard to PEM

- Global Shocks: Global slowdown, Federal rates (for eg. reversal of quantitative easing), Trade wars, Oil prices etc. impact the budget estimates which in turn impacts the subsidies allocation and tax revenue collection.

- Narrow tax net: More reliance on indirect tax makes the taxation policy more regressive. It also constrains the government to increase its social spending, which is low in India as compared to other major global economies.

- Less capital expenditure: Budget’s capital expenditure is essential to ensure inter-generational equity and competitiveness of the economy. It has remained around 10%-12% of government expenditure.

- Populist tendencies: This leads to unproductive spending of the scarce government resources. For eg. giving tax sops, farm loan waivers in the pre-election period.

- Fiscal deficit: Keeping the deficit within the desired limit is essential for maintaining the fiscal prudence.

- Managing public debt: It is essential to ensure that the burden of the current generation’s needs doesn’t fall on the next generation.

- Trade deficit: It should be reduced in order to have healthier global trade and improve market competitiveness.

- Containing inflation: It is one of the most important objectives of monetary policy which is also impacted by the revenue and expenditure policies of the government.

- Estimates of revenue and expenditure: In order to have effective PEM, comprehensive and realistic estimates of revenue and expenditure are essential. Currently, there is uncertainty in providing correct budget estimates.

- Ensuring equitable development across regions: One of the pressing challenges faced by the government with regard to public expenditure management is to ensure equitable development across the regions.

- Inadequate capacity and efficiency of public institutions: Substantive portion of budget allocation towards various schemes remains unutilized and underutilized due to poor implementation and structural bottlenecks. It leads to poor efficiency and cost overruns. For e.g. stalled road projects.

Government measures for effective PEM

- FRBM (Amendment) Act: Government has targeted to reduce the fiscal deficit gradually and stabilize it by 2023 to 2.5%.

- Removing Plan/Non-plan distinction: Removing plan/non-plan distinction and instead adopting the revenue-capital classification of public expenditure will help in allocation of more resources for creation of capital assets which in turn will help in improving the efficiency of economy.

- Monetary policy framework: Inflation targeting by the Monetary Policy Committee has helped in price stability, which is key to effective PEM.

- Deepening of Fiscal Federalism: More tax revenue has been devolved to states from the divisible tax pool. It would help in better allocation of scarce resources based on the needs of states.

- Monitoring system framework: It has been developed at the central level to enable the outcome budgeting. Also, it enables the timely assessment of resource utilization. E.g. Public Financial Management System (PFMS).

With the 1991 reforms, the Indian economy was linked with the global economy. The effective PEM becomes more essential in this globalised era to meet various objectives of state policy. Various fiscal targets should be followed prudently and monitoring of resource utilization should be made robust.

-

2019

What are the reformative steps taken by the Government to make the food grain distribution system more effective?

The National Food Security Act (NFSA), 2013 provides for the Right to Food as a legal entitlement by providing subsidized food grains to nearly two-thirds of the population. However, the current food grain distribution system is fraught with various defects.

Issues with the Food Grain Distribution System